Responsible Investing: Align Your Portfolio with Your Values

At Advitize Financial Solutions, we believe that you shouldn't have to choose between financial growth and global impact. Our Environmental, Social, and Governance (ESG) investment strategies allow you to pursue competitive financial returns while supporting companies committed to a sustainable future.

ESG factors—environmental stewardship, social responsibility, and sound corporate governance—are increasingly recognized as crucial indicators of long-term business resilience and financial performance. We meticulously evaluate these criteria to build portfolios that reflect your principles without compromising your financial aspirations.

Discover Your ESG ValuesOur Evidence-Based Approach to ESG Investing

Our methodical approach to ESG investing is designed to provide robust, sustainable portfolios through a multi-faceted strategy:

ESG Integration

We integrate ESG factors into traditional financial analysis, identifying risks and opportunities often overlooked by conventional investing.

Positive & Negative Screening

We identify ESG leaders and innovators while rigorously excluding harmful industries, ensuring your investments align with your ethical stance.

Thematic & Impact Investing

We offer opportunities to invest in sustainability trends (e.g., clean energy, sustainable agriculture) and direct impact initiatives.

Active Ownership

We believe in shareholder engagement, utilizing proxy voting and advocacy to encourage better corporate governance and sustainability practices.

Comprehensive Evaluation

Our process includes continuous monitoring and analysis of ESG performance, adapting to evolving market dynamics and sustainability innovations.

Comprehensive ESG Investment Solutions

Advitize Financial Solutions offers a diverse range of ESG investment options tailored to meet various financial goals and personal values:

- ESG Equity Funds: Focused on publicly traded companies with strong sustainability practices and responsible governance.

- Green Bond Investments: Support projects with positive environmental or climate benefits, offering stable income while fueling ecological transitions.

- Impact Investing Opportunities: Direct investments aimed at generating measurable social and environmental impact alongside financial returns.

- Sustainable Sector ETFs: Exchange-Traded Funds targeting industries at the forefront of sustainability, such as clean energy, water technology, and sustainable agriculture.

- ESG-Integrated Balanced Portfolios: Diversified portfolios incorporating ESG criteria across various asset classes for comprehensive sustainable investing.

- Canadian ESG Funds: Dedicated funds concentrating on Canadian companies leading in sustainability and social responsibility.

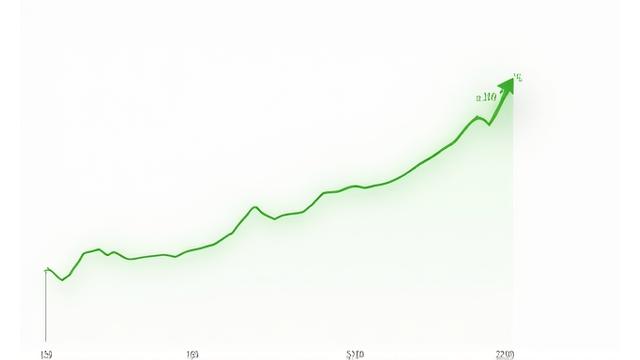

ESG Performance: Competitive Returns with Positive Impact

Concerns about sacrificing returns for impact are often unfounded. A growing body of evidence demonstrates that ESG-integrated portfolios can offer competitive, and often superior, performance over the long term, coupled with reduced risk.

- Academic Research: Numerous studies indicate a positive correlation between strong ESG practices and financial outperformance.

- Risk Reduction: Companies with robust ESG policies often exhibit lower volatility and greater resilience during market downturns.

- Long-Term Trends: Sustainable investing is not a trend but a fundamental shift, with long-term outperformance observed in many ESG indices.

- Canadian Leadership: Canada's market has seen significant growth in ESG adoption, with leading companies demonstrating strong performance.

Measuring and Reporting Your Investment Impact

Transparency is key to responsible investing. Advitize Financial Solutions provides clear, concise reporting on the positive impact your investments are making beyond financial returns.

- Environmental Metrics: Track your portfolio's contribution to carbon footprint reduction, renewable energy generation, or resource conservation.

- Social Impact: Understand your investments' role in promoting fair labor practices, community development, and diversity.

- Governance Improvements: Monitor advancements in corporate transparency, executive compensation, and shareholder rights.

- UN SDG Alignment: See how your portfolio aligns with the United Nations Sustainable Development Goals.

- Regular Reporting: Receive comprehensive reports detailing both financial and impact performance.

Integrating ESG Factors into Your Investment Strategy

Our process ensures that ESG considerations are seamlessly woven into your overall financial plan, customized to your unique objectives.

ESG Assessment

We begin by understanding your personal values and preferences for environmental, social, and governance criteria.

Portfolio Construction

Building a diversified portfolio that balances your ESG objectives with your financial goals, risk tolerance, and time horizon.

Ongoing Monitoring

Continuous evaluation of your portfolio's ESG performance and financial returns, with regular strategy reviews and adjustments.

We are committed to client education on emerging ESG trends and their implications for your investments, ensuring you remain informed and confident in your choices.

ESG Investment Success Stories

Hear from clients who have successfully aligned their wealth with their values through Advitize Financial Solutions.

The Renewable Energy Investors

"As passionate environmentalists, we wanted our investments to reflect our commitment to a greener future. Advitize helped us build a portfolio heavily weighted in clean energy and sustainable technology. Not only are we contributing to a better planet, but our returns have also been robustly competitive."

— Sarah & Mark T., Vancouver

The Community Builder

"My goal was to generate stable income in retirement while supporting companies with strong social impact. Advitize introduced me to impact investing opportunities and socially responsible funds that have provided both consistent dividends and a sense of purpose. It's truly wealth with conscience."

— Dr. Emily R., Victoria

The Ethical Growth Seeker

"As a young professional, I wanted to ensure my portfolio grew responsibly and avoided industries I didn't believe in. The Advitize team helped me understand ESG screening and build a portfolio that aligns with my values, offering peace of mind and excellent growth potential."

— David L., Toronto

Start Building Your Values-Aligned Investment Portfolio

Ready to explore how ESG investing can align your financial goals with your personal values? Our expert advisors are here to guide you.

Schedule a personalized consultation with Advitize Financial Solutions to discuss:

- Your individual ESG values and impact preferences.

- Tailored ESG investment strategies that suit your risk profile.

- How to measure and report the positive impact of your portfolio.