Unlock Your Wealth Potential with Professional Investment Advisory in Vancouver

At Advitize Financial Solutions, we transform your investment approach from guesswork to strategic advantage. Our data-driven portfolio management combines rigorous analysis with personalized strategies to optimize your risk-adjusted returns, helping Vancouver clients build lasting wealth.

- Proactive risk management tailored to your comfort level

- Intelligent diversification across global asset classes

- Tax-efficient strategies designed for the Canadian landscape

- Continuous performance monitoring and strategic rebalancing

Ready to make your money work harder? Request your complimentary portfolio review and investment strategy consultation today.

Request a Free Portfolio Review

Our Client Success

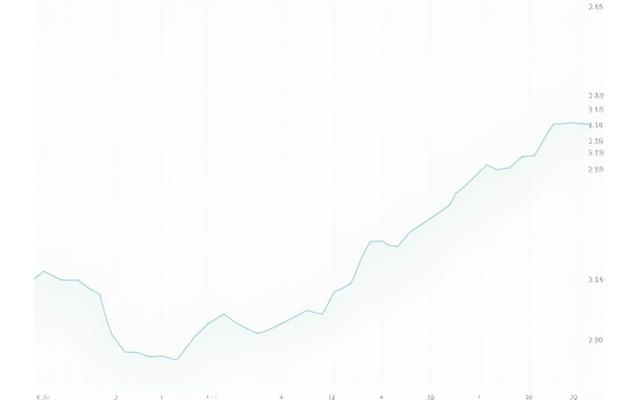

+8.5% Average Annualized Return (2020-2023)

-15% Reduced Portfolio Volatility for Managed Accounts

Our Time-Tested Investment Philosophy

We believe in a disciplined, evidence-based approach to wealth creation, prioritizing long-term growth and capital preservation over speculative trends.

Long-Term Wealth Building

Our focus is on sustainable growth, leveraging market cycles and compounding returns rather than chasing short-term gains. We construct portfolios designed to withstand volatility and deliver consistent performance over decades, aligning with your life goals.

Strategic Diversification

We advocate for broad diversification across various asset classes, industries, and geographic regions to mitigate risk and capture opportunities. Your portfolio will be thoughtfully constructed to blend growth assets with stable income-generating investments.

Evidence-Based Investing

Our strategies are rooted in academic research and proven market principles, not speculation. We utilize robust data analysis and financial models to make informed decisions that align with empirical evidence, ensuring a sound foundation for your investments.

Proactive Risk Management

Understanding and managing risk is central to our process. We implement dynamic asset allocation and regular rebalancing to maintain your desired risk profile, protecting your capital during downturns while positioning for recovery.

Tax-Efficient Strategies

Minimizing your tax liability is crucial for maximizing net returns. We employ sophisticated tax-efficient investment strategies, including tax-loss harvesting and careful consideration of account types, specifically designed to benefit Canadian investors.

Comprehensive Investment Advisory Services

Advitize Financial Solutions offers a full spectrum of investment advisory services, meticulously designed to meet your unique financial objectives and risk tolerance.

Portfolio Management & Rebalancing

We construct and actively manage diversified portfolios, conducting regular reviews and rebalancing to ensure alignment with your financial goals, market conditions, and personal circumstances.

Investment Research & Due Diligence

Leveraging institutional-grade research tools and expert analysis, we identify compelling investment opportunities and rigorously vet all potential holdings to safeguard your capital.

Tax-Efficient Investment Placement

Our strategies include sophisticated techniques like tax-loss harvesting and strategic asset location to minimize your tax burden and enhance your net investment returns in Canada.

Alternative Investment Opportunities

Access carefully selected alternative investments such as Real Estate Investment Trusts (REITs) and exclusive private placements to diversify beyond traditional stocks and bonds.

ESG & Socially Responsible Investing

Align your investments with your values. We offer expertise in ESG (Environmental, Social, and Governance) integrated investing, allowing you to invest responsibly without compromising returns.

Regular Performance Reporting

Receive clear, concise performance reports and timely market commentary. We provide transparency and insights into your portfolio's progress, ensuring you're always informed.

See How We Optimize Your Investment Portfolio

Our proven methodology enhances portfolio performance and manages risk effectively. Explore tangible examples of how Advitize Financial Solutions transforms portfolios.

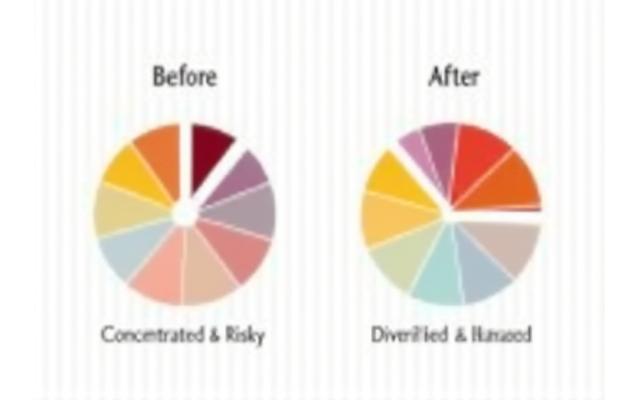

Before & After: Enhanced Diversification

Moving from concentrated holdings to a strategically diversified portfolio significantly reduces idiosyncratic risk. We optimize your asset allocation to broaden your exposure and smooth out returns.

Risk Optimization for Conservative Investors

For investors prioritizing capital preservation, we employ specific strategies to reduce volatility and protect your principal, ensuring a peace of mind while still participating in market upside.

Tax Efficiency Improvements

We demonstrate how strategic tax planning within your investment portfolio can lead to substantial improvements in your overall net returns, keeping more money in your pocket.

Growth Optimization for Aggressive Investors

For those with a higher risk tolerance and longer time horizon, we implement aggressive yet prudent growth strategies, identifying high-potential assets and sectors to maximize returns.

Investment Success Stories from Vancouver Clients

Hear directly from our clients whose financial futures have been transformed through our strategic investment advisory services.

Advitize helped me transition from haphazard investing to a clear, actionable plan. In three years, my portfolio has seen consistent growth, exceeding my expectations. Their tax-efficient strategies have been a game-changer.

Sarah L.

Tech Professional, Vancouver

As I approached retirement, Advitize expertly rebalanced my portfolio for income generation and capital preservation. I now feel confident and secure about my financial future thanks to their guidance.

Michael T.

Retired Educator, West Vancouver

We sought Advitize for their expertise in alternative investments and ESG options for our family foundation. Their insights have been invaluable, allowing us to generate strong returns while staying true to our mission.

Dr. Emily R.

Family Foundation Trustee, North Vancouver

Transparent Investment Management Fees

At Advitize Financial Solutions, we believe in clear, straightforward pricing. Our asset-based fee structure ensures our success is directly aligned with yours, with no hidden fees or commissions.

| Assets Under Management (AUM) | Annual Advisory Fee |

|---|---|

| First $500,000 | 1.25% |

| Next $500,000 (up to $1M) | 1.00% |

| Next $1,000,000 (up to $2M) | 0.75% |

| Above $2,000,000 | Negotiable, often 0.50% |

Our Fee Philosophy: Fiduciary & Aligned

As a fiduciary, our advice is always in your best interest. Our transparent fee structure means our compensation grows only when your investments grow. Unlike many banks or mutual funds with embedded fees, our direct approach gives you complete clarity on costs.

Value-added services included at no additional charge:

Detailed performance reporting, regular client reviews, financial planning integration, and tax planning consultations.Estimate Your Potential Fees

Use our simple calculator to see how our transparent fees compare.

Your estimated AUM: $500,000

Estimated Annual Fee: $6,250

How to Begin Your Investment Advisory Relationship with Advitize

Starting your journey toward optimized wealth management is a straightforward four-step process designed for clarity and efficiency.

Complimentary Consultation & Portfolio Review

Our initial meeting is a no-obligation opportunity for us to understand your financial landscape, goals, and concerns. We'll conduct a comprehensive review of your current investments to identify strengths and areas for improvement.

Investment Policy Statement (IPS) Development

Based on our discussions, we'll collaboratively develop a detailed Investment Policy Statement. This document formally outlines your financial objectives, risk tolerance, time horizon, and the specific guidelines for managing your portfolio.

Portfolio Implementation & Funding

Once the IPS is finalized, we assist with the seamless transfer of assets and the strategic implementation of your tailored investment portfolio. We handle all the administrative details, making the transition effortless for you.

Ongoing Monitoring & Regular Communication

Your portfolio will be diligently monitored by our team, with adjustments made as needed to react to market shifts and life changes. We proactively schedule regular reviews to discuss performance, reconfirm goals, and address any new financial considerations.

Ready to Optimize Your Investments?

Take the first step towards a more secure financial future with a complimentary, no-obligation portfolio review.

Our experts will analyze your current holdings, identify opportunities for growth and efficiency, and outline a tailored strategy designed specifically for you. No pressure, just professional insight.

Book Your Free Portfolio Review TodayPrefer to speak directly? Call us at +1 604-555-0188 or email us at [email protected].